Reward Differently: The Value of ICHRA for Your Employees

by Richie Seaberry

by Richie Seaberry

If you’re a small business owner with less than 50 employees, you may not be required to offer health insurance. Offering health benefits is a powerful way to stand out in today’s competitive job market and attract top talent.

People are choosing employers who offer more than just a paycheck. They want stability, support, and real benefits. To compete, and keep your team happy, it may be time to think beyond raises.

Here’s a smarter way: Offer an ICHRA (Individual Coverage Health Reimbursement Arrangement) to add more value to your team.

What’s ICHRA?

ICHRA allows employers to help cover the cost of health insurance without offering a traditional group plan. Instead of managing one plan for everyone, you simply decide how much you’d like to contribute each month. Your employees can then use that money to pay for a health plan that works best for them from their state’s ACA marketplace. It’s a flexible solution that adapts to your team’s unique needs — because what works for a 20-year-old might not work for a 55-year-old with a family.

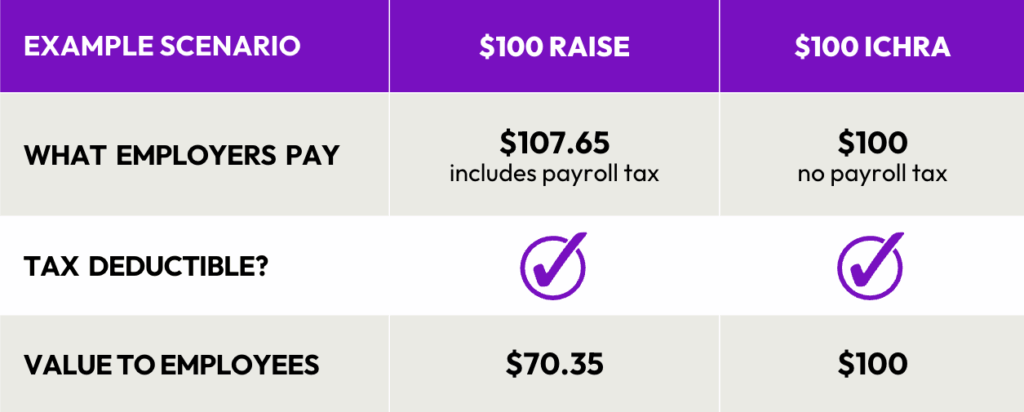

For example — you’re likely already offering raises to retain top talent. But have you ever compared what a $100 raise really delivers — to you and to your employees?

Here’s the breakdown:

That’s 7% savings for you and 42% more value for your employee.

How ICHRA Benefits Small Businesses

- Fits teams of any size — skip the participation minimums that come with most group plans.

- Cost control — set a monthly budget that works for your business and don’t worry about rate increases.

- Simple setup — Decisely ICHRA combines technology with benefits advisors, no HR department needed.

- Improve retention — when you’re helping cover health costs, your team’s a lot less likely to leave. Benefits can be a game-changer for loyalty.

Why A Raise Isn’t Always the Better Benefit

Giving raises is one way to invest in your team, but it’s not always the most efficient. Raises get taxed on both sides: employers pay payroll taxes, and employees see a chunk of it go to income and FICA taxes. So that $100 raise? It costs you around $107.65 and your employee ends up with only $70.35. With ICHRA, you both win!

Start Small, Think Big

You don’t need to offer a significant amount per employee to make a meaningful impact. Even a modest contribution can show your team you care about their well-being. It could be the difference between keeping your best people and losing them to a competitor!

Want to Learn More?

We help business owners set up ICHRAs that are easy, affordable, and tailored to their needs. No pressure. Just smarter choices for your people.

Reach out today to find out how ICHRA can support your business goals.

?

?